In a time when financial security is a must, the search for long-term wealth demands both strategy and flexibility. Whether you’re a new investor or a seasoned financial planner, you must know that long-term wealth accumulation involves sensible saving, strategic investing, and disciplined budgeting. Let’s explore 15 ways to build long-term wealth and prepare for a prosperous future.

Invest in Financial Education

The basis of any successful wealth-building attempt is knowledge. Start by educating yourself with the basics of personal finance and then delve into more complicated topics. Consider joining online courses or workshops to develop your understanding of economic concepts. By preparing yourself with good financial knowledge, you’ll make informed decisions and confidently direct the challenges of wealth development!

Automate Your Finances for Efficiency

Simplify money management by programming repeated tasks. Set up automatic transfers from your checking account to your savings or investment accounts to ensure constant contributions. You can also set up automatic payments for repeated bills to avoid late fees and penalties. Through the power of automation, you’ll update your financial workflow and free up time for other activities.

Attach the Power of Compound Interest

Time is your most valued benefit when it comes to building wealth. Start investing early to influence the power of compound interest. Explore various investment methods, such as individual stocks, mutual funds, exchange-traded funds (ETFs), and real estate. Consider opening a retirement account to take advantage of tax-deferred development opportunities. By starting early and staying well-organized, you’ll make the most of the growth potential of your investments over time.

Plan Your Financial Goals

Building wealth without a clear roadmap is like sailing without a compass. The first step is to note down your short-term and long-term financial aims. Be as detailed and realistic as possible, whether it’s about funding your kids’ education, purchasing a home, or retiring securely. Creating clear targets gives you an accurate framework to direct your wealth-building attempts and measure your growth.

Some steps that might help you set financial goals are as follows:

- Identify what is most important to you.

- List your short-, medium-, and long-term financial goals.

- Compare your earnings and expenses.

- Keep track of your accomplishments and those you still plan to achieve.

- Make alterations to your goals as needed.

Craft a Complete Financial Plan

Developing a complete financial strategy is essential, but you must remember your goals during the process. Use available resources to understand effective investment strategies and portfolio variation and consider seeking guidance from a qualified financial planner who can help you create a plan that aligns with your unique conditions and ambitions. Your financial plan should cover many features, including budgeting, saving, investing, and debt management. This can help you achieve long-term monetary success while reducing unnecessary risks.

Protect Your Wealth with Sufficient Insurance

It is crucial to protect your financial well-being by having sufficient insurance coverage. Explore opportunities for health insurance, life insurance, disability insurance, and property insurance. Consider checking with an insurance agent or financial advisor to calculate your needs and find appropriate policies. By reducing risks and protecting your assets, you’ll ensure greater peace of mind and stability for yourself and your loved ones.

Enhance Tax Efficiency

Take advantage of tax-efficient investment methods to improve your returns and reduce tax liability. You may explore opportunities like contributing to retirement accounts, recovering tax losses, and using tax-favored investments such as municipal bonds or health saving accounts (HSAs).

Consider Entrepreneurship

Step into the field of entrepreneurship and create your way to wealth. Whether you’re starting a business, picking up a side hustle, or freelancing, entrepreneurship offers unlimited possibilities for growth and success. Foster creativity, take calculated risks, and seek opportunities to help you make your place in the market.

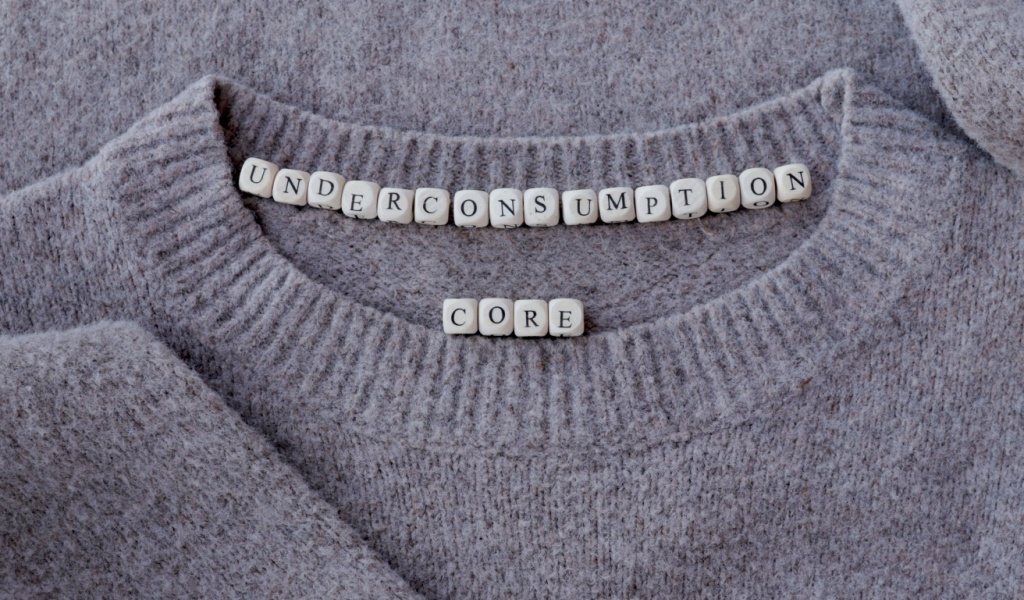

Practice Mindful Spending and Saving

With inflation and the cost of living at an all-time high, living within your resources can be a challenge. However, being mindful is the main principle of wealth accumulation. Separate necessary expenses from optional buying and organize your financial goals accordingly. Track your spending, find areas where you can cut back, and send those savings toward your long-term aims. You’ll build a solid financial basis by living economically and saving methodically.

Invest in Real Estate

Real estate investments can be a great tool for building long-term wealth. Some ways to leverage real estate investments are buying rental properties, flipping houses, or investing in real estate investment trusts (REITs). Real estate offers the possibility of inactive income, portfolio change, and capital appreciation.

Invest in Human Intellectual Assets

Your ability to earn money is your most valuable asset, so it is worth investing in yourself by learning new skills, following advanced education, and growing your professional network. Seek out opportunities for career development, added certificates, or specialized training programs. By improving your skills and knowledge, you’ll place yourself for greater earning potential and greater career opportunities in the long run!

Explore Alternative Investments

Differentiate your investment portfolio by exploring alternative options such as precious metals, cryptocurrencies, or peer-to-peer lending platforms. While these investments carry higher risks, they also offer the possibility for massive returns and can serve as a cover against traditional market instability.

Encourage a Spirit of Generosity and Giving

True wealth is measured not only by material assets but also by our influence on others’ lives. Include generosity in your financial plan by supporting programs that align with your values and. Whether you donate to charitable organizations, volunteer your time, or participate in community activities, giving back enhances both the giver and the receiver!

Stay Aware and Adapt to Changing Conditions

The financial landscape is active and continuously growing. Stay up-to-date on market trends, economic factors, and regulatory changes that may influence your financial plan. Be open-minded and adjustable, willing to reconsider your strategies and turn around when required. By accepting change and innovation, you’ll make way for success in an ever-changing world.

Practice Patience and Discipline

Building long-term wealth needs patience, discipline, and perception. Avoid getting caught in get-rich-quick schemes or risky investments that promise overnight success. Instead, concentrate on developing a disciplined savings habit, continuing your investment strategy, and trusting the power of combining over time.

Building long-term wealth is a complicated task that requires careful planning, discipline, and determination. Using these complete strategies in your financial plan will set a solid base for a secure future. Remember, wealth is measured not only in monetary terms but also in the quality of life it pays for and its positive influence on others.

Start your wealth-building journey today and embark on the path to financial victory!